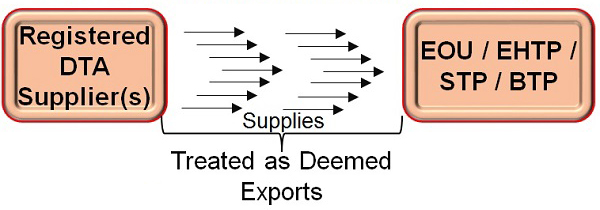

Refer to those transactions in which goods supplied do not leave country and payment for such supplies is received either in Indian rupees or in free foreign exchange. Following are supplies covered under Deemed Exports-

Supply by Manufacturer:

- Supply of goods against Advance Authorisation/Advance Authorisation for annual requirement/DFIA.

- Supply of goods to EOU/STP/EHTP/BTP.

- Supply of capital goods against EPCG Authorisation.

- Supply of marine freight containers by 100%EOU. Provided said containers are exported out of India within 6 months or such further period as permitted by customs.

Supply by Main /Sub Contractor (S):-

- Supply of goods to projects financed by multilateral or bilateral agencies/funds as notified by Department of Economic Affairs, Ministry of Finance, where legal agreements provide for tender evaluation without including customs duty;

- Supply and installation of goods and equipment to projects financed by multilateral or bilateral agreements/funds as notified by Department of Economic Affairs for which bids have been invited and evaluated on the basis of Delivered Duty Paid prices for goods manufactured abroad;

- Supply of goods to any project or for any purpose in respect of which the Ministry of Finance, by Notification No. 12/2012-Customs, dated 17.3.2012 as amended from time to time, permits import of such goods at zero customs duty subject to conditions specified in the said Notification;

- Supply of goods required for setting up of any mega power of project subject to the condition that such mega power project conforms to the threshold generation capacity specified in the above said Notification;

- Supply of goods to UN or International Organizations for their official use or supplied to the Projects financed by the said organizations approved by Government of India;

- Supply of goods to nuclear power projects provided-Such goods are required as specified in the list 33 at Sl. No. 511 of Notification No. 12/2012-Customs, dated 17.03.2012 as amended from time to time;

- The project should have a capacity of 440 MW or more;A certificate to the effect is required to be issued by an officer not below the rank of Joint Secretary to Government of India, in Department of Atomic Energy;

Notification No. 48/2017-Central Tax, dated 18.10.2017 DGFT’s notification no. 33/2015-2020, 13th October, 2017

Conditions for Refund of Deemed Export Drawback

The following are the conditions for refund of deemed export drawback:

- In case CENVAT credit/rebate has not been availed on the inputs/input services, by the supplier of goods, then, benefit as per Column ‘A” of All Industry Rate of Duty Drawback Schedule shall be admissible;

- If CENVAT credit/rebate has been availed by the supplier of goods, on inputs/input services, then, no drawback shall be admissible as per column ‘B’ of All Industry Drawback Schedule. However in such cases, Basic customs duty paid can be claimed as brand rate of Duty Drawback based upon submission of documents evidencing actual payment of duties.

Procedures

Claims should be filed within a period 12 months from date of receipt of supplies by project authority or from the date of receipt of the payment by supplier as per the option of the applicant either against a particular project or all the projects. The claims may also be filed where part payments have been received. Deemed export benefits may be allowed after 100% supplies have been made. The benefit, however, will be limited to the extent of payment received.

In case claim is filed after the prescribed time period, the late cut will be done as detailed below:

- Application received after the expiry of last date but within six months from the last date – 2% cut;

- Application received after six months from the prescribed date of submission but not later than one year from the prescribed date – 5% cut;

- Application received after 12 months from the prescribed date of submission but not later than 2 years from the prescribed date – 10% cut.

“ Thanks to this legal company, I got all my property back and got mytation restored. The team of professional Consultants will surely to this legal company, I got all my prsucceed in your Consultants will surely case too.”