WHAT IS AEO

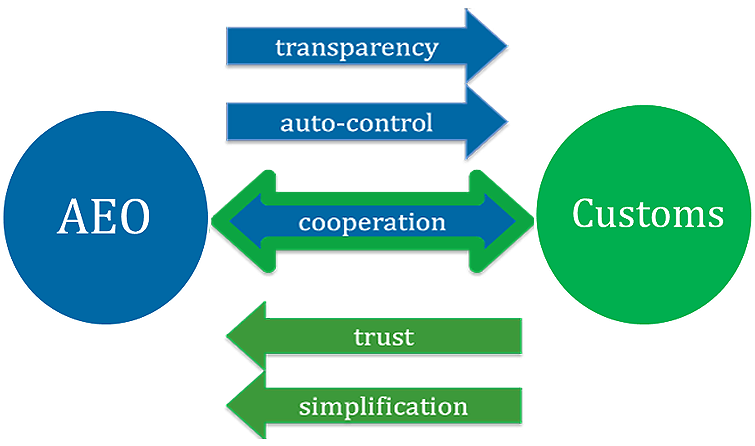

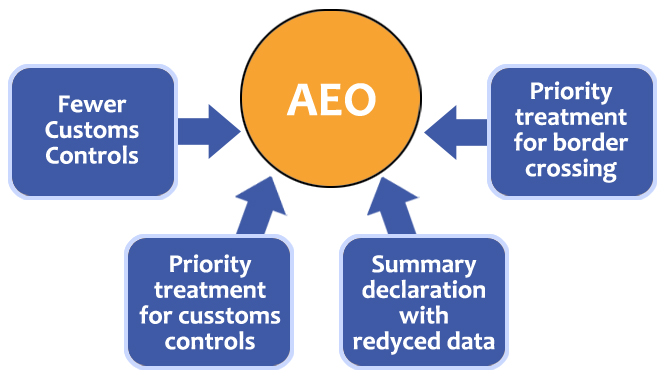

Authorised Economic Operator Programme seeks to provide tangible benefits in the form of faster Customs Clearance and simplified Customs procedures to those businesses who offer high degree of security. This Is recognised by WCO. Indian businesses can be benefited worldwide by Mutual recognition Agreement of India with other countries.

AEO programme is open to all importer/exporters :-- The Applicant must be established in India

- Have business activities since last three years

- Have filed at least 25 Bills of entries or Shipping Bills in the last financial year.

- No SCN issued to them in last three financial years.

Type OF AEO, Applicability and Validity period

| CERTIFICATION | WHO CAN APPLY | VALIDITY PERIOD |

|---|---|---|

| AEO-T1 Certificate | Only Importer and Exporter can have T1, T2 & T3 certificate. | 3 Year |

| AEO-T2 Certificate | Only Importer and Exporter can have T1, T2 & T3 certificate. | |

| AEO-T3 Certificate | Applicant must have continuously enjoyed the status of AEO-T2 for at-least a period of two years preceding the date of application for grant of AEO-T3 status. | 5 Year |

| AEO-LO Certificate | Other than importers and exporters, namely Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators. | 5 Year |

BENEFITS OF AEO T-1, T-2, T-3

| Benefits | AEO-T1 Certificate | AEO-T2 Certificate | AEO-T3 Certificate |

|---|---|---|---|

| High level of facilitation | Yes | Yes | Yes |

| Direct Port Delivery import/export container | Yes | Yes | Yes |

| ID cards to authorized personnel for hassle free entry to Custom Houses, CFSs and ICDs. | Yes | Yes | Yes |

| Separate space earmarked in Custodian’s premises | Yes | Yes | Yes |

| Reduction on Bank Guarantee | 50% reduction | 75% reduction | 100% reduction |

| Investigations, if any, would be completed, in six to nine months | Yes | Yes | Yes |

| Dispute resolution within six months | Yes | Yes | Yes |

| E-mail regarding arrival/ departure of the vessel carrying their consignments | Yes | Yes | Yes |

| 24/7 clearances on request at all sea ports and airports | Yes | Yes | Yes |

| Seal verification/scrutiny of documents by Custom officers would be waived | Yes | Yes | Yes |

| Deferred payment of Duty | No | Yes | Yes |

| BEs/SBs will be processed on priority | Yes | Yes | Yes |

| Faster completion of Special Valuation Branch (‘SVB’) | Yes | Yes | Yes |

| Shorter cargo release time | Yes | Yes | Yes |

| Facility to paste MRP stickers | No | Yes | Yes |

| Access to their consolidated import/export data | No | Yes | Yes |

| Paperless declarations with no supporting documents in physical form. | No | Yes | Yes |

| Client Relationship Manager”(CRM at the level of Deputy / Assistant Commissioner available at port who will act voice of AEO holder | Yes | Yes | Yes |

| Expedite refund of IGST | - | 45 Days | 30 Days |

| No Merchant Overtime Fee (MOT) | No | Yes | Yes |

Benefits For AEO-LO Certificate

| Logistic Service Providers, Custodians or Terminal Operators, Customs Brokers, Warehouse Operators |

Waiver of bank Guarantee. Facility of Execution of running bond. Exemption from permission in case of transit of goods. Faster approval for new warehouses within 7 days Waiver of solvency certificate. Waiver of security Waiver from fee for renewal of license. |

There will be OSPCA after three years in T-1 and T-2 and after 5 years in LO and T-3 at the time of review of AEO Status.

Conclusion:

After the finance bill 2011 there has been a shift in Assessment in Customs as Section 17 has been amended, any BOE/SB filed is SELF ASSESSED by you, as per Circular 17/2011 and vide the BOE regulation 2011 and Shipping Bill Regulation 2011, Now since it is your assessment, It is time to come forward and accept that it is your assessment and register as AEO.

CIRCULAR 33/2016 DATED 22.07.2016 AMENDED BY CIRCULAR NO.3/2018 DATED 17.01.2018

Simplification and rationalization of processing of AEO-T1 application- reg Circular No. 26/2018-Customs

“ Thanks to this legal company, I got all my property back and got mytation restored. The team of professional Consultants will surely to this legal company, I got all my prsucceed in your Consultants will surely case too.”